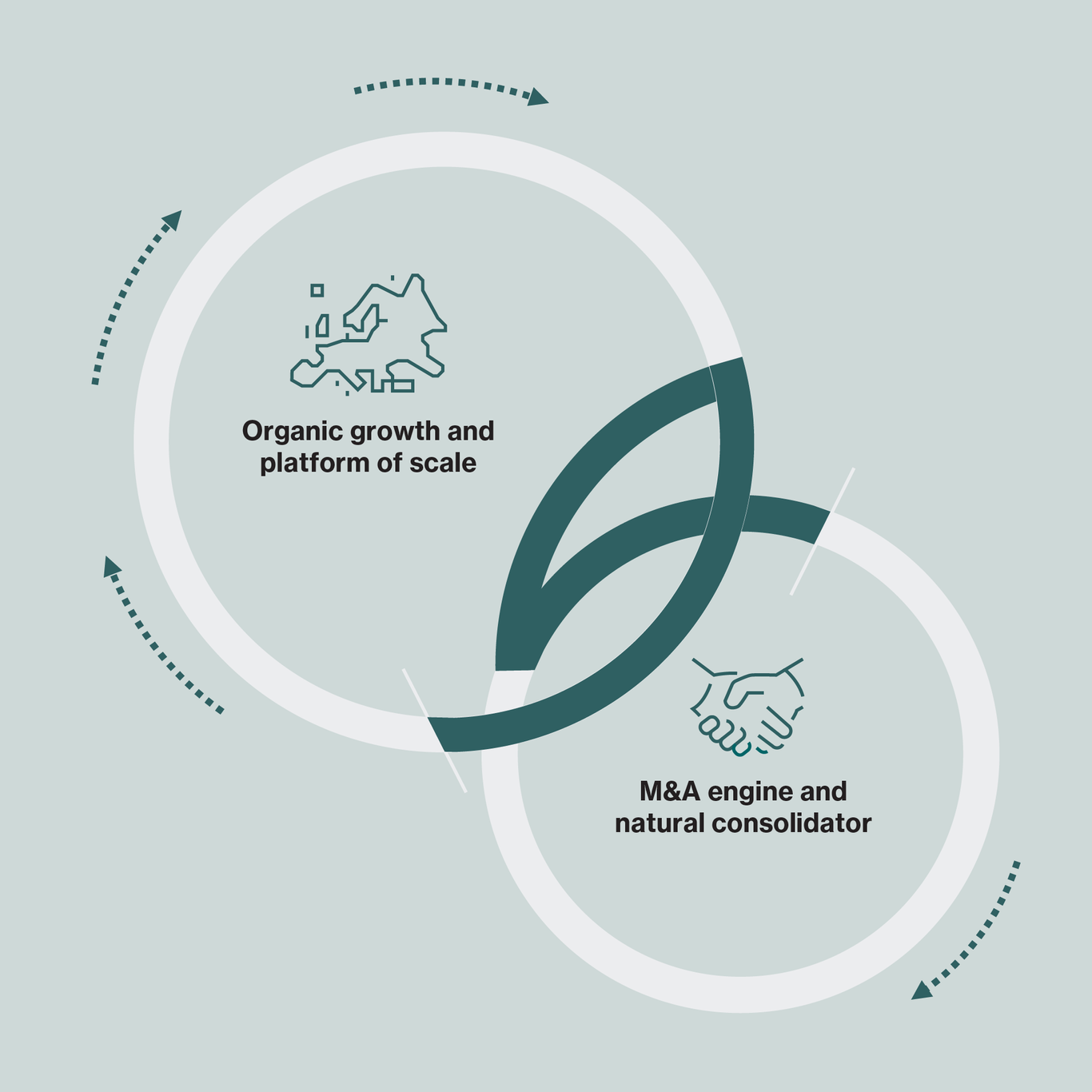

Asker’s Twin Engine

Asker’s vision is to be the leading healthcare group in Europe within medical products and solutions, by building and acquiring companies that together with healthcare providers and patients create better health for all. To achieve this vision, Asker has adopted a “twin engine” growth strategy that combines organic and acquired growth.

The first engine, organic growth, is fuelled by local entrepreneurs driving growth in their companies.

The organic growth is driven by increasing customer trust in the group’s companies, achieved through expanding existing contracts, winning new business, and moving into new product areas and customer segments.

The second engine, acquisitions, boosts the pace of expansion.

Asker also focuses on structural growth through attracting and welcoming new companies to the Group. The local entrepreneurs play a key role in the acquisitions process by identifying potential target companies and building relationships with the owners concerned.

The interaction between the two engines drives strong growth.

The two engines interact and reinforce each other, strengthening the company's market position and ability to drive change. The stronger position attracts more market-leading companies to the Group and creates economies of scale that drives the creation of efficient and value-creating solutions.

Asker's strategy for value creation is based on two distinct, but interlinked components that combine organic growth with acquisitions.

Asker's strategy for value creation is based on two distinct, but interlinked components that combine organic growth with acquisitions.